Getting My Hard Money Georgia To Work

Wiki Article

The Hard Money Georgia Diaries

Table of ContentsThe Facts About Hard Money Georgia Revealed7 Easy Facts About Hard Money Georgia ShownOur Hard Money Georgia DiariesFacts About Hard Money Georgia RevealedAn Unbiased View of Hard Money Georgia

The larger down settlement requirement mirrors the increased problem in selling a commercial building, as there are much less customers for commercial buildings contrasted to houses. If a debtor defaults on a business difficult money loan as well as the residential or commercial property is repossessed by the hard money loan provider, the list price might need to be marked down dramatically so the loan provider can recoup their investment with a quick sale.If you're seeking to acquire a residence to flip or as a rental building, it can be testing to obtain a standard mortgage. If your credit rating isn't where a typical lending institution would like it or you need cash money faster than a lending institution has the ability to offer it, you might be unfortunate.

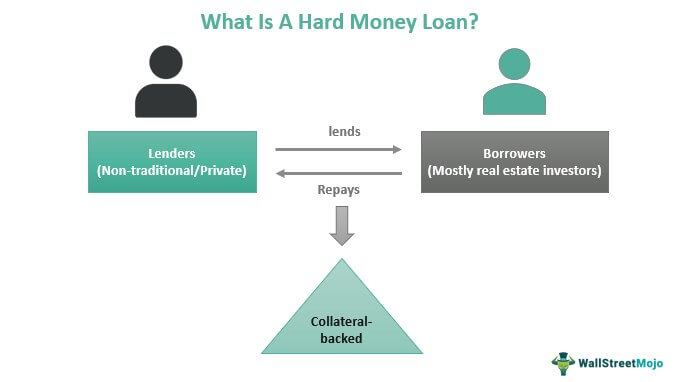

Hard money car loans are temporary safe financings that utilize the residential property you're acquiring as security. You will not find one from your bank: Hard money fundings are provided by alternate loan providers such as private financiers as well as private firms, who generally ignore mediocre credit ratings and also other economic variables and also rather base their decision on the residential property to be collateralized.

What Does Hard Money Georgia Do?

Hard cash lendings provide several benefits for borrowers. These include: From beginning to complete, a tough cash funding might take simply a few days - hard money georgia.It's key to consider all the perils they subject. While difficult cash finances featured benefits, a borrower needs to also take into consideration the dangers. Among them are: Tough cash loan providers commonly bill a greater rates of interest due to the fact that they're presuming more danger than a typical lender would. Once more, that's due to the danger that a tough cash lending institution is taking.

Every one of that adds up to indicate that a tough cash loan can be a pricey way to borrow money. Choosing whether to get a difficult money financing depends in large component on your situation. All the same, make sure you evaluate the risks as well as the expenses before you join the dotted line for a difficult cash finance.

The Definitive Guide for Hard Money Georgia

You're unsure whether you can manage to pay off the hard money financing in a short period of time. You've obtained a solid credit report as well as must have the ability to qualify for a typical funding that most likely brings a lower passion rate. Alternatives to difficult cash lendings consist of conventional home mortgages, home equity fundings, friends-and-family fundings or funding from the building's seller.

It is essential to consider variables such as the lending institution's credibility and also rate of interest. You could ask a trusted realty agent or a fellow home flipper for recommendations. When you have actually nailed down the ideal hard cash loan provider, be prepared to: site link Develop the deposit, see it here which typically is heftier than the down repayment for a standard home mortgage Gather the necessary documents, such as proof of earnings Possibly hire a lawyer to review the terms of the car loan after you have actually been accepted Map out a method for repaying the lending Just as with any type of loan, evaluate the pros as well as cons of a difficult money funding before you devote to borrowing.

The 20-Second Trick For Hard Money Georgia

Regardless of what kind of funding you select, it's probably a good idea to examine your complimentary credit report and also free credit record with Experian to see where your finances stand.

The difference in between tough cash and also private money is not that clear. What is the distinction in between difficult cash and also personal cash? And also which loan provider should you go with?

6 Easy Facts About Hard Money Georgia Shown

This advantages genuine estate financiers in a couple of ways: as you do not require to jump through as numerous hoops image source to get personal or hard cash, you can occasionally have your financing authorized in less than a week. With typical funding, your credit report score has to satisfy specific requirements. Nonetheless, that's not the situation with tough and also personal lenders.This additionally assists you spread out the risk as opposed to taking it all upon yourself. Exclusive lenders can be extremely innovative with lending terms, whereas difficult money finances do not have any type of early repayment charge. These are just a number of methods in which these 2 lendings are extra adaptable than going down the standard funding path.

Actually, if they comply with all the borrowing laws, anyone with additional money or a spent interest in your real estate financial investment can be brought in as a personal money lender. Comparable to tough cash financings, the funds consumers get from a personal lender typically go towards the purchase price as well as remodelling of a property.

Report this wiki page